By David Hosler, CPCU, MBA

What is a Group Captive?

Group Captive Insurance Programs can be an attractive alternative to conventional insurance. They can withstand the cyclical nature of the traditional insurance marketplace while offering their owners more control over the total cost of risk and allowing them to share in the financial success of the captive.

Group captives are one of three major types of captives available in the alternative risk transfer marketplace and are often the choice for companies with annual sales of roughly $20 million to $750 million. Individual or single-parent captives, as the name implies, are owned by a single entity and are popular among Fortune 1000 companies with larger risk profiles and expected loss history. The third type, agency captives, are controlled by insurance agents/brokers who participate in insuring the risks of their clients.

We will focus our efforts on the benefits and operating details of group captives, as they appeal to a broad audience of potential participants.

It should be stressed that entering a group captive is a long-term play, as one of its main features is to provide greater long-term cost stability than traditional insurance allows. Ultimately, the underwriting profits of the captive are achieved by sound underwriting of new members and consistent and sustained implementation of agreed safety and risk management practices throughout the group. Accordingly, careful consideration should be given to each key benefit and weighed against the potential drawbacks of joining group captive before committing to this method of risk transfer.

Many companies have concluded that group captives as the best risk financing mechanism for them.

Currently, more than 2000 companies representing more than $2 billion in premiums have chosen the group captive approach to manage their risks.

What exactly are group captives? They are not overly complicated, or illegal in any way, nor are they a magic wand for all risk transfer situations. They are an insurance company that provides insurance to its owners. The insureds are the owner/operators of the company, which means they have greater control of membership, safety/loss control culture, claims management, and purchasing of re-insurance. In turn, they reap the benefits when the captive is profitable (versus the insurance company in a traditional insurance program). Additionally, premiums paid into group captives by the members are afforded the same tax deductibility as traditional insurance.

Frequently Cited Benefits of Group Captives

Most companies who have entered a captive arrangement did so to enjoy the overall control and stability afforded by the captive structure, combined with the realization that the traditional insurance premiums they were paying were no longer bringing acceptable financial value or leverage to them.

Other key benefits include:

- As a shareholder, you accrue tax-deferred underwriting profit, while benefiting from the investment income of the captive.

- Your premiums are directly related to your loss experience – not insurance industry averages.

- 65-70% of the premiums are available to fund losses and generate investment income.

- Leverage your company’s safety record and culture to directly impact your premiums.

- Collaboration with fellow members, often in similar industries to improve Risk Management efforts.

- Greater control of Claims Management.

- Direct access to reinsurance markets for pricing above the captive retention.

- Insuring risks that may otherwise be un-insurable.

- Ability to draft your insurance coverages.

- Protect your company’s assets – A captive is a legal entity, separate from your company.

- Captive profits are distributed to owners in the form of dividends.

What is my role?

When entering a group captive you will become a fractional owner of an insurance company. Your lens now shifts from viewing yourself as a purchaser of insurance products to someone responsible for the long term profitability and viability of the company. For your efforts, you will insulate your company to a large degree from the normal insurance market cycles, while sharing in the captives’ underwriting profits in a tax-deferred manner (until the profits are distributed as dividends).

So you might be thinking, “well this sounds interesting, but I have enough on my plate running my own company, I don’t have the time or expertise to run an insurance company”. The good news is the captive industry has developed a professional network of qualified resources to allow the captive owners to have minimal administrative obligations. These services include providing the recommended structure of the captive, feasibility studies for new members, domiciling location, claims management, legal, actuary, accounting, and other functions required to operate the captive effectively.

Captive members do participate as owners in some functions similar to how they would in any other company. They serve on executive boards, or sub-committees that are formed to provide the key areas strategic direction to areas like underwriting guidelines, risk control/safety parameters for new or current members, or investment/finance of premiums and losses. They usually meet twice per year, often in the location where the captive is domiciled.

Historically, captives were domiciled in off-shore locations that had more favorable environments for the formation of the captive, and tax laws around the accumulation of its underwriting profits. Recently, many states have adopted more favorable state laws that removed some of the tax and formation obstacles that prevented captive owners from choosing a U.S. based domicile. Domestic domiciles such as Vermont, Nevada, and Montana have become very active in recruiting captives.

Am I an Ideal Candidate?

A captive could be an ideal risk transfer method for you if you meet the following criteria:

- Casualty Premiums that exceed $150,000-$200,000 (Auto, General Liability and Workers Compensation)

- Profitable company with sound financial statements

- Favorable loss history with some level of frequency losses

- Proactive approach to loss control/safety

- An entrepreneurial attitude

Feasibility Study

Feasibility studies are offered by most captive management companies and are essential to understanding the fundamental question “what is my return of investment by using a captive?”

Prospective members (shareholders) of group captives should have a good understanding of what to expect when their capital is deployed to join in ownership of an insurance company.

A good feasibility study will determine the payback period and rate of return on capital utilized to join the captive. The study will also contain other key considerations such as:

- Analysis of potential risks/coverages to be placed into the captive

- An actuarial summary that will detail premium rates, rating methodology, and ultimate loss projections (loss pick)

- Understanding of how the claims management process will work

- Analysis of loss reserve and corresponding collateral requirements

- Fronting company options

- Reinsurance options

- Analysis of capitalization requirements – premiums, collateral, and assessment limits

- Expense projections for the captive

- Evaluation of best domiciling location for the captive

- Overview of relevant tax considerations

- Five-year Pro-forma financial statement performance of captive

- Dividend allocation protocols/procedures

The feasibility study can be completed within a 90-120 day timeframe in most cases and will require the following data from the prospective member:

- Most recently completed Y/E audited financial statement and projections for the current year

- Most recently completed interim financial statement

- Current schedule of insurance coverages and policies

- 5-10 years of currently valued claims history in captive eligible coverages

- 5-10 years of prior exposure data – sales, payrolls, vehicle counts, etc.

Captives need premium volume to be viable – if your business is too small, financially unstable, or your current insurance premiums and losses are too low to offset the fixed costs associated with operating the captive, a quick evaluation can help you conclude without perhaps conducting the full feasibility study.

Typical Group Captive Structure

While each group captive may have specific features unique to their group, the overall structure for each is very similar. Group captives have three separate types of funds used to manage the loss activity and fixed costs associated with the captive.

Frequency Fund (A Fund)

- This fund is used to provide loss capitalization for “frequency” losses to an established limit of losses, and also referred to as the A Fund. A typical A Fund limit would provide first-dollar claim coverage for the first $75,000-$100,000 of loss. In this layer of self-coverage, each member assumes initial responsibility for their losses, and risks are not shared.

- If one company has a lot of small claims, the other members will not be impacted. There is an incentive for each member to try to control the claims in the A Fund loss layer. If a member’s losses exceed their frequency (A Fund) premium in a year, they will be charged a Loss Experience Charge (LEC) for the overage. Each member can be assessed one additional frequency fund as the LEC to replenish the fund.

Severity Fund (B Fund)

- This loss layer sits on top of the Frequency Fund and provides a pooled layer for the per claim losses that are more than the Frequency Fund up to the limits retained by the group captive.

- This fund is typically referred to as the B Fund. A typical B fund limit would be $250,000 or $300,000.

- Similar to the spirit of traditional insurance, each member contributes to the B Fund to fund the losses that pierce the A Fund limit up to the lower limit of the captive reinsurance layer, or reinsurance attachment point. The difference in the B fund from A Fund is this layer of coverage is shared among all of the other members of the captive, once the member has exhausted all his available loss funds.

- Larger, more unpredictable losses are covered by the fund to protect the members from the infrequent large claims.

- The Severity fund will normally account for 20%-25% of the total loss premium, while the Frequency Fund accounts for 75%-80% of the total loss premiums.

Reinsurance and Administration Fee Fund:

- Premiums allocated to this fund are used to pay both the reinsurance and administrative expenses of the member company to participate in the captive.

- The reinsurance expenses would include the premiums and taxes charged by the fronting insurance company to assume the risk for claims that exceed the severity funds limit (B Fund limit), aggregate protection to the captive for losses that exceed all members loss funds (both A Fund and B Fund) and any Loss Experience Charges (LEC).

- The Reinsurance and Administration fees usually account for about 40% of the total premium, while the Frequency and Severity Funds accounting for 60%.

The three premium components are combined to arrive at the final premium for each captive member. Administrative expenses would normally include loss control and claims administration expenses, captive management fees, accounting fees, and brokerage commissions.

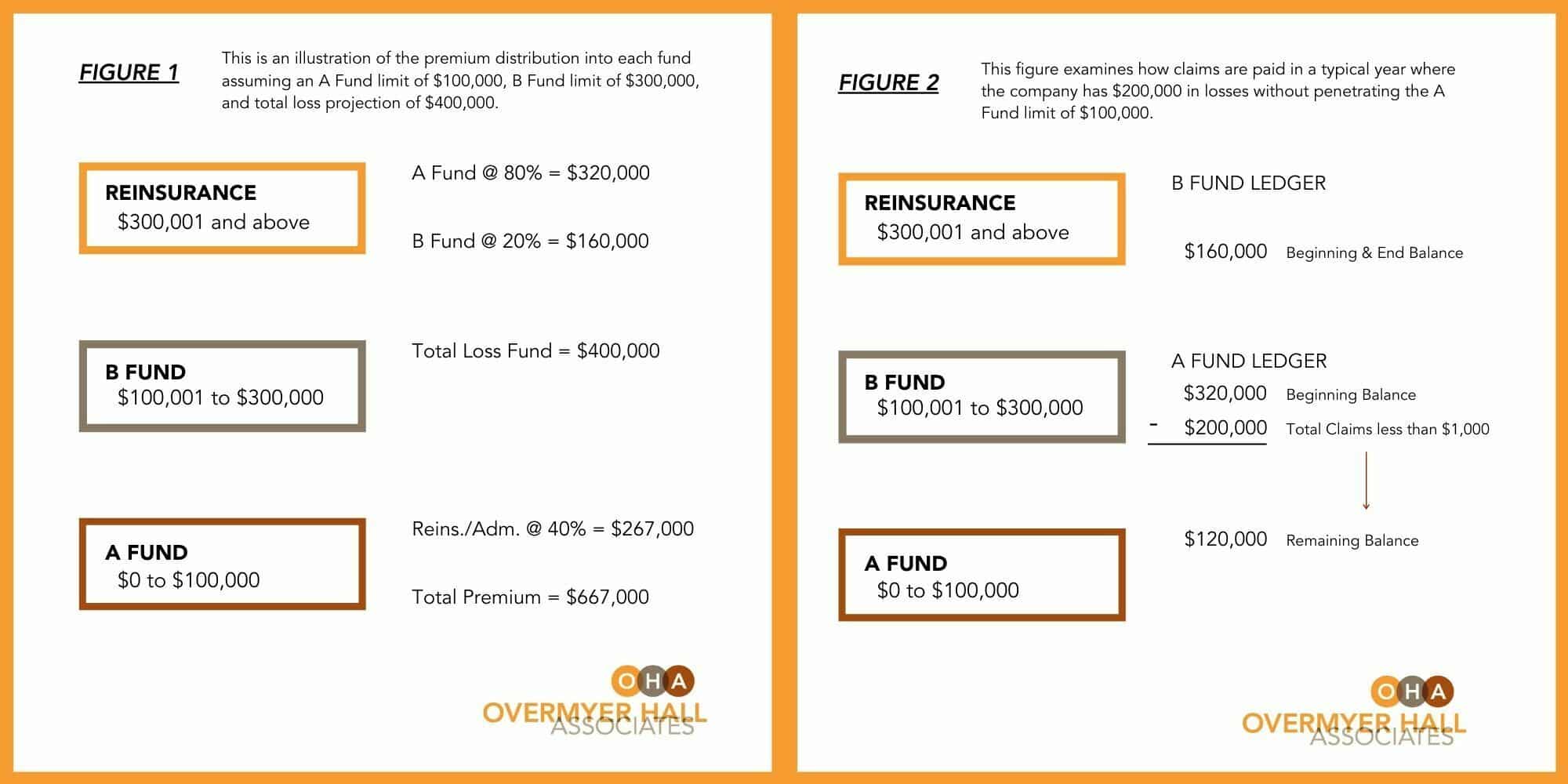

Below in Figure 1, is an illustration of the premium distribution into each fund assuming an A Fund limit of $100,000, B Fund limit of $300,000, and total loss projection of $400,000.

In Figure 2, we examine how claims are paid in a typical year where the company has $200,000 in losses with none penetrating the A Fund limit of $100,000

This year would be closed out with $120,000 in the A Fund and $160,000 in the B Fund for a total of $280,000 in the combined funds. This surplus would be eligible upon board approval for dividend distribution to the member, however, there is typically a two-to-four year lag period for dividend distribution to allow for any future development of loss activity in the eligible policy period.

Also, the loss activity in our example would most likely not close out in a year, the funds set aside for their ultimate expected payout are in an interest-earning account and will continue to accrue interest until they are paid in full or closed out.

Our example closed out with $280,000 remaining in the loss fund, and over the next two-to-four years, while the claims are reaching final disposition, they might cost another $40,000 in legal fees, outstanding medical, and other claims-related costs.

These additional costs will be offset by earning interest on the $280,000 balance in the loss fund. Using a 3% return would produce a total of $306,000 compounded annually to offset the $40,000 of estimated additional claims handling fees, for a net return of $266,000. With this payout pattern, three years after the company closed out the year, they could receive a dividend distribution for $266,000 – that’s in a year where they had $200,000 of claims.

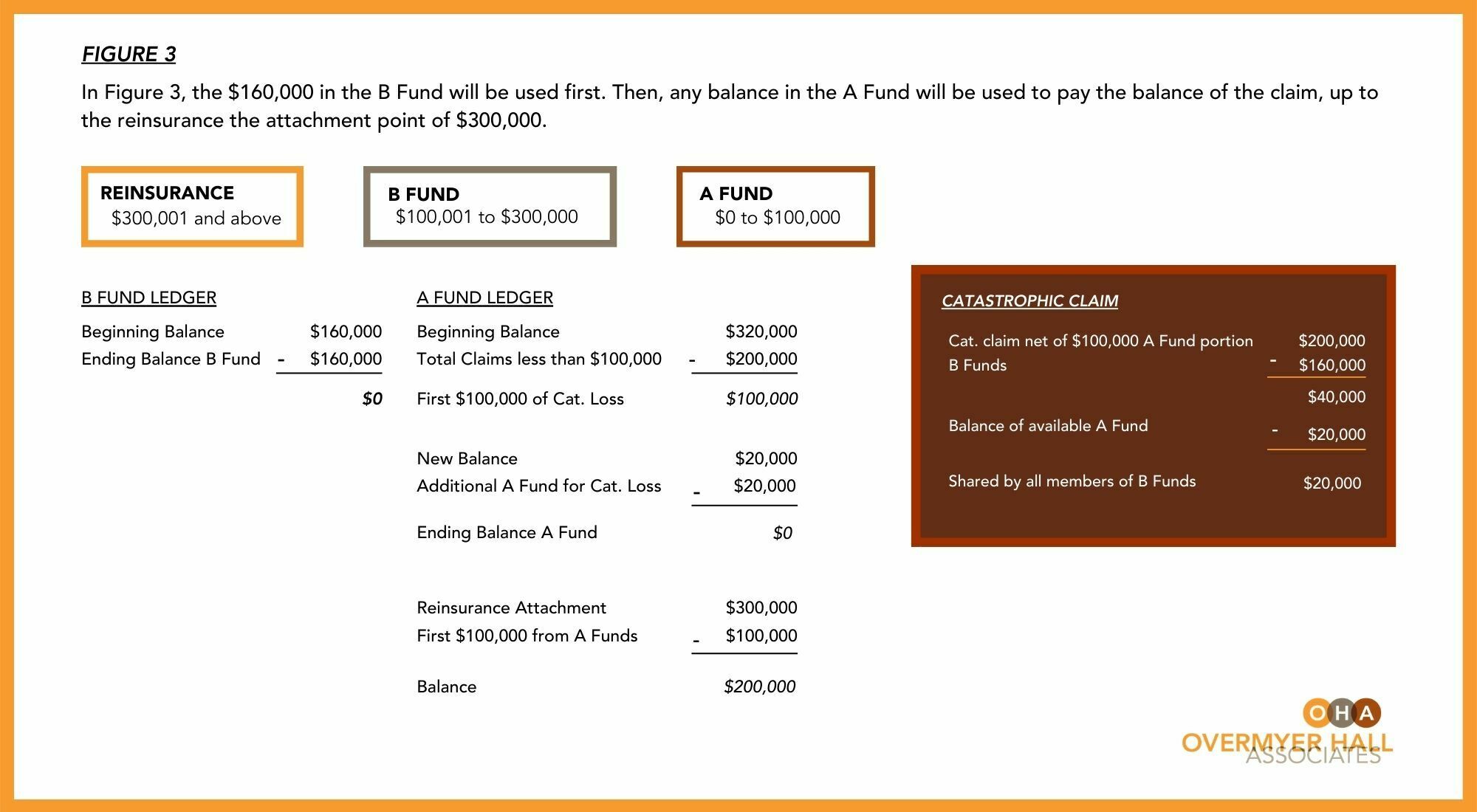

Finally, we will consider a year that did not go well for the company. Using the same loss activity at the prior example except in this case we will add a large loss of $1 million. These results will most likely not make the company feel so good about their decision to join the captive, but not horrific.

Of the $1 million loss, the captive will only be responsible for the first $300,000 of loss, the balance will be covered by the reinsurance layer (this hit will impact the reinsurance premiums going forward – but market conditions and other underwriting considerations will also be a factor).

As shown in Figure 3, the $160,000 in the B Fund will be used first. Then, any balance in the A Fund will be used to pay the balance of the claim, up to the reinsurance attachment point of $300,000.

In this example, our A Fund and B Fund available contributions are short by $20,000. This will be a shared obligation spread amongst all of the captive members in proportion to the size of their overall loss funds as a percentage of the whole.

In this example, our company has depleted its loss funds, they will be required to reconstitute the fund.

This can be done by an assessment – in this case replenishing both the A and B funds since both have been depleted.

This has to be done to pay for losses throughout the year. Other adverse claim situations may call for only a partial assessment, but there must be funds available.

This is the primary reason why safety and loss prevention are so important when managing losses in group captives. The company is directly accountable for all the losses.

Conclusion

For many, the initial reaction to the workings of group captives can be overwhelming. It is very important to understand that group captives are an alternative risk management tool – and they are not for everyone. The primary benefit group captives will provide an organization is the control over their loss dollars. This control will allow the company to leverage the loss dollars that would normally go to finance the inferior risk management practices of other companies in a traditional insurance market.

Financially sound companies that are interested in managing their losses and have a strong safety culture are the most desired members by established group captives. The market place has abundant capacity for new members that fit this profile and have adequate amounts of premium in the casualty lines of General Liability, Auto, and Workers Compensation.

About Overmyer Hall Associates

Overmyer Hall Associates is one of the fastest growing agencies in the country, quickly becoming one of the largest property and casualty insurance agencies in Central Ohio. Overmyer Hall Associates provides clients with insurance and risk management, specializing in Business Insurance, Surety Bonding, and Home & Auto Insurance. Since its founding in 2011, the firm has been awarded Columbus Business First’s "Fast 50" and "Best Places to Work" awards, the IIABA’s “Best Practices Agency” recognition, Columbus CEO Magazine’s “Best Insurance Broker” and the Columbus Young Professionals Club’s “Wonderful Workplace for Young Professionals” award. www.oh-ins.com